Having been involved in local issues for more than a decade, I keep telling myself to no longer get involved. When I come across some local issue or decision that infuriates me, I tell myself, “Tony, don’t get involved. Step away from the keyboard.” But like Michael Corleone, in the Godfather, “Just when I thought I was out, they pull me back in.”

The attached DDN article, demonstrates the basic problem with the people we elect to manage our government. The vast majority of them have no concept of what the proper functions of government are at the city, state and federal levels.

The article covers several local cities, but we will concentrate on Beavercreek notables. Take a look at the quote by city councilman Jerry Petrak: “We had three separate golf consultants come in. All came to the conclusion that the course would be very viable. In retrospect, they were wrong.”

No Mr. Petrak, YOU WERE WRONG. A golf course is not a proper function of Beavercreek city government. The consultants were just doing their job, what exactly do you think a golf consultant was going to say? It was up to you to consider what was in the best interests of the city’s taxpayers. Those decisions are made by having a solid understanding of what should and what should not be funded by public money. If you, and others on the council at the time, would have thought along those lines, you would not have had to make the decision to build or not to build because you wouldn’t even have had contracted the consultants in the first place.

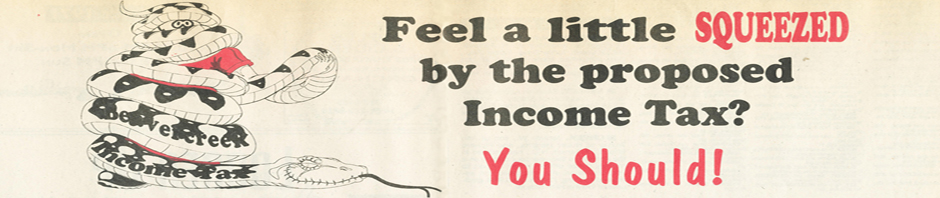

Yet, during the income tax debate, Jerry Petrak, Brian Jarvis and other council members were still defending the golf course. Even after the tax defeat, Mr. Jarvis is still going around, including on Facebook, saying the golf course was a good decision. Mr. Jarvis justifies the golf course by saying the property values of the homes near the course have increased. Then why not build one in every neighborhood? Specifically, please build another one by my house; pretty please, with a cherry on top. Preferably a par 3, so I can watch every hole play out. You can include a pond and some traps, but no trees, I don’t want any obstructions to my view. Since Mr. Jarvis claims he plays golf; I promise to give him a friendly wave from my chair as he plays through.

Seriously though, quit defending the indefensible! Does anyone in government understand the issues here?

We keep voting people into office, hoping they understand their roles in a society with limited government. What is limited government at the local level? You start with “roads and commodes,” i.e., infrastructure (yes this includes police and fire) after that, there isn’t much left. We can throw in parks, but you have to be careful, to a person in the Government Class, a golf course is a park.

I have come to the conclusion that no matter what some of these esteemed and distinguished people say, on the stump, or after being elected, whether they are from the Left, Right, or in the middle, they never come across a tax or a government program they don’t like. I guess the lure of having a new building with a plaque dedicated to them is just too tempting. Either they don’t understand their duties, are persuaded to act against their own beliefs, or just become corrupt.

And we continue to pay for it.

And they wonder why they lost the tax vote.